In events like hurricanes or tornadoes, homeowners face a critical period of vulnerability. Not only do they need to address the damages to their property, but they must also navigate the challenge of finding trustworthy contractors for repairs. Unfortunately, this is also when unethical contractors appear, looking to exploit the situation.

Understanding Contractor Scams

Contractor scams occur when firms or individuals offer repair services that intentionally mislead homeowners. These scams may involve poor-quality work, inflated prices, or outright fraud—where services are paid for but never completed. Recognizing these scams is the first step in protecting yourself and your property.

Key Red Flags to Watch For

-

Unsolicited offers

One of the first red flags. If a contractor shows up at your door without you having contacted them first, especially after a disaster, be wary. They often use high-pressure sales tactics to get you to agree to repairs you might not need.

-

Out-of-State Contractors

Be cautious of contractors who are from outside your area. These individuals often follow disasters to make quick money and leave town. They might need valid licenses or insurance, and it can be difficult to track down if there are issues with their work. Hiring someone local with a reputation to uphold in your community is usually safer.

-

Licensing and Insurance Verification

Always ask a contractor for their state license and proof of insurance. Verify these with your state’s Contractors Board to ensure they are active and legitimate. If a contractor cannot provide this information, it’s a strong sign you should not hire them.

-

The Danger of Verbal Agreements

Never agree to any work based on a verbal agreement. Ensure you have a written contract specifying the work scope, expenses, and schedules. A lack of willingness to provide a written contract is a major red flag.

-

Upfront Payment Requests

Be cautious if a contractor asks for full payment upfront. While it’s common for contractors to request a deposit, you should only pay the full amount when the work is completed to your satisfaction. Your contract should detail the payment schedule.

Signs of Trouble Once Work Begins

Communication Breakdown

If your contractor begins to avoid communication or if there are unexplained delays in the work, these could be signs of trouble. Maintaining regular communication is essential for any project’s success.

Subcontractor Issues

If subcontractors start contacting you directly for payment, this could indicate that the primary contractor still needs to pay them. This can lead to liens against your property for their unpaid bills.

Unexpected Costs

While some projects might have unforeseen costs, frequent or unexpected expenses can signify a scam. Always question these costs and consider getting a second opinion if something feels wrong.

Proactive Measures to Protect Yourself

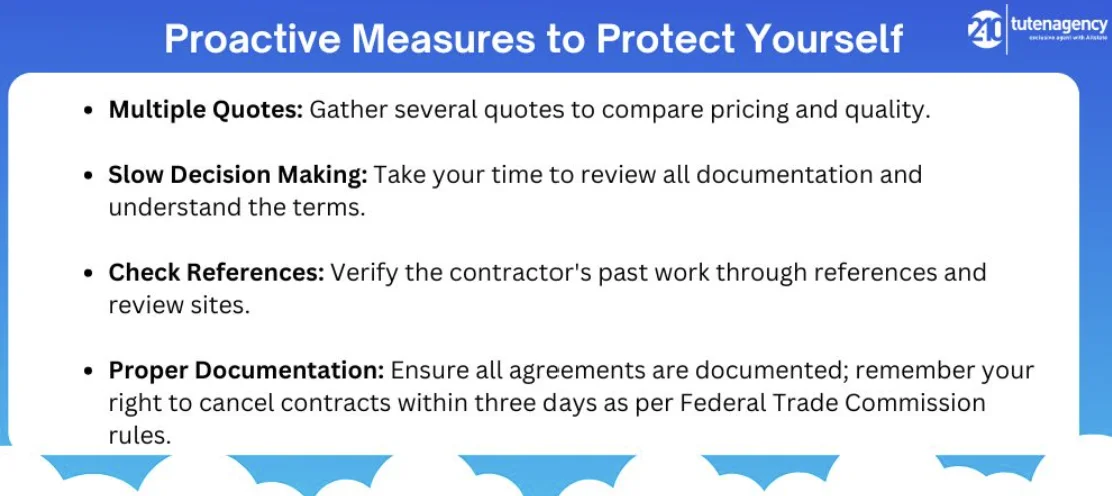

Gathering Multiple Quotes

Before deciding on a contractor, get multiple quotes. This helps ensure you are getting fair pricing and high-quality service. It also gives you a better idea of what your project should reasonably cost.

You are taking your time to decide

Take your time making a decision, thoroughly reviewing all quotes and contracts, and making sure you understand all terms before signing anything.

Checking References and Affiliations

Always verify a contractor’s references and research them on reputable review sites. Additionally, confirm their affiliations with professional organizations to ensure their credibility.

Ensuring Proper Documentation

Make sure all estimates and contracts are written down. Federal Trade Commission rulings say you can cancel any contract signed at home or a contractor’s temporary business location within three business days.

Summary

After bad weather damages your home, you might feel rushed to fix everything quickly. However, making quick decisions can lead to problems if you hire the wrong contractor. It’s very important to carefully check out any contractor before agreeing to work with them. Choose local, trustworthy contractors to ensure your repairs are done right and safely.

Always take your time when dealing with repairs. It’s best to talk to local, well-known companies and check everything you can about a contractor before you start. Being careful can save you money and prevent a lot of stress.

FAQs

What are the typical signs that a contractor may be scamming me?

Contractor scams can manifest in several ways including persistent unsolicited offers, demands for full payment upfront, and a lack of proper licensing or insurance. Be wary of contractors who use high-pressure sales tactics or refuse to provide a written contract.

How can I verify a contractor’s credentials?

Always request to see a contractor’s state license and proof of insurance. Check these credentials with your state’s Contractors Board or appropriate regulatory authority to confirm they are valid and active.

What should I do if a contractor requests full payment before starting the work?

It’s advisable to avoid paying the full amount upfront. A reasonable deposit is customary, but you should only complete the payment when the work is finished and meets your satisfaction according to the agreed terms.

How important is it to have a written contract with a contractor?

A written contract is crucial as it outlines the scope of work, cost, timelines, and payment schedules, providing a legal safeguard for both parties. Always insist on a written agreement before any work begins.

Get the right coverage for your home with tutenagency

New tutenagency customers?

Quote homeowners insurance online or call (334) 502-5111 to insure your home.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.