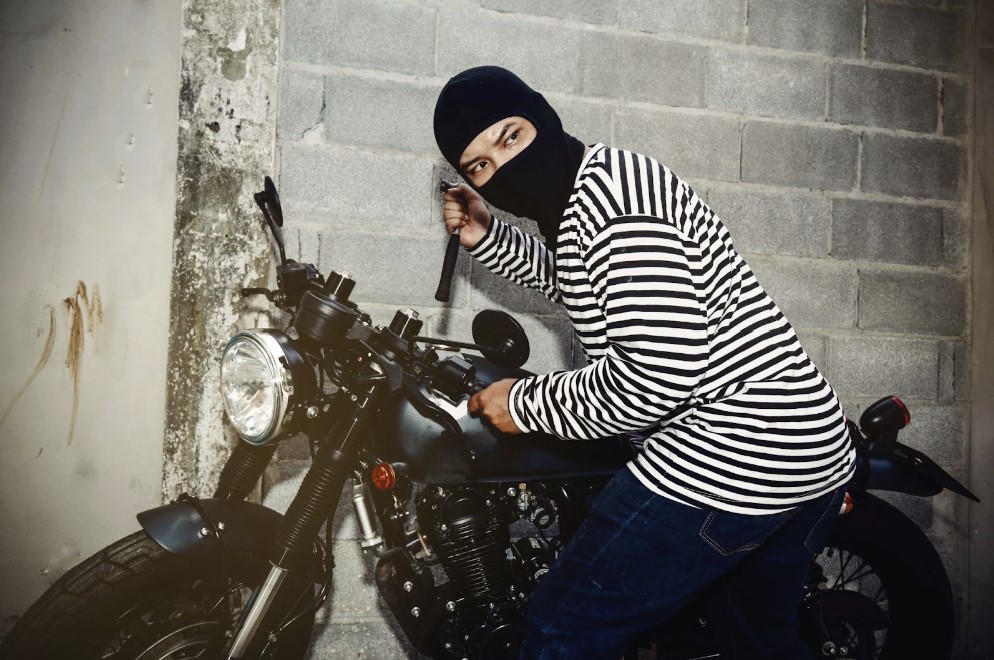

Motorcycle enthusiasts understand that the thrill of the open road comes with inherent risks, not least of which is the potential theft of their prized possession. While the physical and emotional attachment to a motorcycle is irreplaceable, having the right insurance coverage can mitigate the financial loss and offer peace of mind. Comprehensive coverage in motorcycle insurance policies plays a crucial role, offering protection against incidents beyond one’s control, including theft and vandalism.

Comprehensive Coverage: Your Shield Against Theft

At the heart of motorcycle theft protection is comprehensive coverage. This type of insurance is designed to cover the cost of replacing your motorcycle in the event it’s stolen or to pay for repairs if it’s recovered with damages. Unlike basic liability coverage, which most states mandate, comprehensive coverage is optional. However, lenders often require it if your bike is financed or leased.

Moreover, adding coverage for custom parts and accessories is a wise move for those who have customized their bikes with aftermarket parts, such as a unique diamond-stitch seat or specialized exhaust systems. Insurers like Allstate offer this additional protection, ensuring that your investments into customizing your bike are safeguarded against theft.

Vandalism and Home Insurance: Understanding Your Coverage

Comprehensive coverage also extends to damage caused by vandalism. Whether your motorcycle is knocked over, tagged with graffiti, or otherwise maliciously damaged, comprehensive policies offer compensation to restore it to its pre-vandalism condition.

A common misconception among riders is that homeowners or renters insurance might cover the theft of their motorcycle. However, these policies do not extend to motor vehicles. They may cover motorcycle-related items stolen from your home, like riding gear, but the motorcycle is only protected under a specific motorcycle insurance policy.

Immediate Steps Following Theft or Vandalism

Realizing your motorcycle has been stolen or vandalized can be distressing, but taking immediate and correct actions can significantly impact the situation’s outcome. Here are the steps you should follow:

If Your Motorcycle Is Stolen:

- Report the theft to the police immediately: Provide all relevant details, including the make, model, and any identifying features or tracking devices.

- File a claim with your insurance company: Use the information and police report number from your report to facilitate the process.

If Your Motorcycle Is Vandalized:

- Document the damage thoroughly with photographs: This visual evidence is crucial for the claims process.

- Do not use the bike until it has been assessed by a police officer. Riding the motorcycle could complicate the insurance process, as it may cause additional damage or suggest the vandalism was less severe.

Prompt and precise actions are essential for a swift resolution in both scenarios.

The Risk of Theft: Awareness and Prevention

To mitigate the risk of motorcycle theft, especially for owners of high-target brands like Honda, Yamaha, Harley Davidson, Suzuki, and Kawasaki, consider these preventative measures:

- Invest in anti-theft devices: Utilize technology to make your bike less appealing to thieves.

- Park in well-lit and visible areas: Visibility can deter theft attempts.

- Lock the ignition and brakes: Make it as difficult for thieves to simply roll away with your motorcycle.

- Secure the motorcycle to a fixed object: Use sturdy chains and locks to anchor your bike, making it immovable.

- Use quality chains and locks: Invest in high-grade security devices to resist tampering.

- Secure your bike to another bike (if riding with a friend): This creates additional complexity for potential thieves.

Adopting these steps can significantly decrease the likelihood of your motorcycle becoming a target for theft, providing an added layer of security alongside comprehensive insurance coverage.

Conclusion

While the risk of motorcycle theft or vandalism cannot be eliminated, having the right insurance coverage is critical in protecting your investment and enjoying the ride with greater peace of mind. Comprehensive coverage protects against theft and vandalism, ensuring you cannot bear the full financial burden.

By understanding your coverage options, taking immediate action in the event of theft or vandalism, and implementing preventative measures, you can significantly reduce the impact of these unfortunate incidents. Remember, the best defense combines comprehensive insurance coverage and proactive theft prevention strategies.

FAQs

What exactly does comprehensive coverage include for motorcycle theft?

Comprehensive coverage is designed to cover the loss of your motorcycle if it’s stolen, and pay for repairs if it’s recovered with damages. This coverage is optional but often required by lenders for financed or leased bikes.

Is my motorcycle covered against theft under my home or renters insurance?

No, motorcycles are not covered under home or renters insurance policies for theft. These policies typically only cover items within your home, not motor vehicles. However, they might cover motorcycle-related items stolen from your home, like helmets or jackets.

How does comprehensive coverage handle motorcycle vandalism?

Comprehensive coverage compensates for vandalism-related damages to your motorcycle, allowing for repairs to restore it to its pre-vandalism condition. This includes scenarios where the bike is knocked over, tagged, or maliciously damaged in other ways.

Get the right coverage for your motorcycle with tutenagency

New tutenagency customers?

Quote motorcycle insurance online or call (334) 502-5111 to insure a motorcycle.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.