In today’s digital age, businesses increasingly rely on technology and data to operate efficiently and remain competitive. However, this reliance also exposes them to a multitude of risks, particularly in the form of cyberattacks. Cyberattacks can wreak havoc on a business, leading to significant financial losses, reputational damage, and even the potential for bankruptcy.

To safeguard against these risks, businesses need to understand the importance of cyber insurance as a crucial component of their risk management strategy. This article explores the financial risks associated with cyberattacks, the role of cyber insurance in mitigating these risks, and the steps businesses can take to ensure their continuity and resilience in the face of cyber incidents.

Understanding Cyberattacks and Financial Risks

As technology evolves, so do the tactics used by cybercriminals. Understanding the various types of cyberattacks and their potential financial consequences is crucial to appreciate the need for cyber insurance.

Data Breaches: The Costly Impact

Data breaches are one of the most common and financially damaging cyber threats faced by businesses today. Such breaches may lead to the disclosure of sensitive customer information, trade secrets, and intellectual property. The financial consequences of a data breach include expenses related to informing affected individuals, providing credit monitoring services, legal fees, regulatory fines, and the possibility of litigation.

As per the 2022 Verizon Data Breach Investigations Report, there has been a 13% increase in ransomware attacks, equivalent to the total rise seen in the last five years. Proactive measures, such as implementing robust cybersecurity protocols and encryption techniques, are crucial in mitigating the risks associated with data breaches.

Ransomware Attacks: Holding Businesses Hostage

Ransomware attacks are becoming more and more common and can be extremely costly for businesses, regardless of their size. These attacks involve malicious actors encrypting a company’s critical data, making it inaccessible until a ransom is paid. In the initial half of 2023, claims for ransomware insurance reached an all-time high among small businesses, as reported by Coalition, a company specializing in cyber insurance and offering risk management services to businesses.

The costs associated with ransomware attacks encompass not only the ransom demanded by the attackers but also the expenses related to system restoration, data recovery, and potential business interruption. Cyber insurance is crucial in mitigating risks by covering costs incurred in the recovery process.

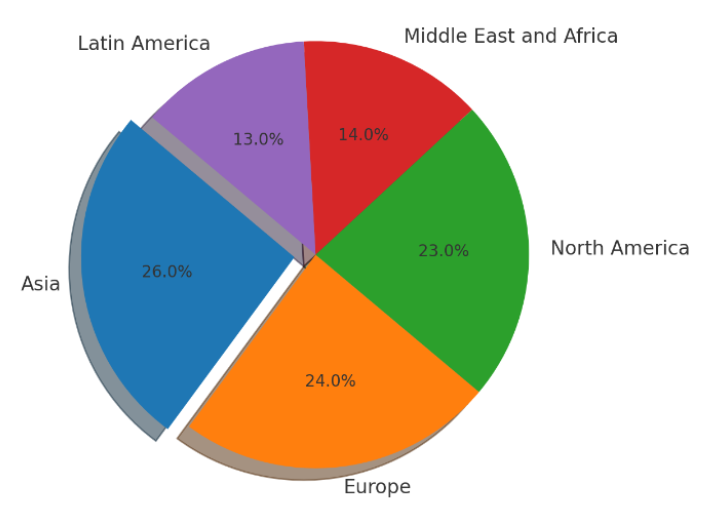

Where are organisations most at risk of cyber crime?

According to aag-it.com, which regions are most vulnerable to cybercrime? In 2021, organizations in Asia experienced the highest number of attacks globally. The distribution of attacks against organizations by continent in 2021 is detailed as follows:

The Role of Cyber Insurance in Recovery

When a cyber incident occurs, businesses must act swiftly to recover from the damages and resume normal operations. Cyber insurance provides essential support in the recovery process by covering various expenses related to data restoration, system repair, and legal obligations.

Coverage for Financial Loss and Liability

Cyber insurance policies provide coverage for various financial losses resulting from cyber incidents. This includes loss of income due to business interruption, data recovery and system restoration costs, legal fees incurred from potential lawsuits, and even damages owed to third parties affected by the breach. With appropriate cyber insurance coverage, businesses can minimize the financial burden and protect their bottom line.

Business Interruption: Ensuring Continuity

One of the most significant consequences of a cyber incident is the disruption it causes to business operations. Cyber insurance can play a pivotal role in ensuring business continuity during these challenging times.

By providing financial support during periods of interruption, businesses can cover ongoing expenses, retain key employees, and maintain customer trust. This support can be critical in helping businesses recover and resume operations as quickly as possible.

Choosing the Right Cyber Insurance Policy

Selecting the most suitable cyber insurance policy requires careful consideration of various factors. Businesses should evaluate coverage limits, exclusions, deductibles, and policy terms to address their specific needs and risks adequately. Additionally, industry-specific risks and compliance requirements should be considered when choosing a cyber insurance policy.

Collaborating with experienced insurance professionals can provide valuable guidance in navigating the complex landscape of cyber insurance and tailoring coverage to meet the business’s unique needs.

Best Practices for Cyber Risk Mitigation

While cyber insurance offers financial protection, businesses must also adopt proactive measures to reduce the likelihood and impact of cyberattacks. Implementing strong cybersecurity measures, such as robust firewalls, encryption protocols, and multi-factor authentication, can significantly enhance the security posture of a business.

Regular employee training programs on cybersecurity best practices and conducting vulnerability assessments can help identify and address potential weaknesses in the system. By adopting these best practices, businesses can fortify their defenses against cyber threats and lower insurance premiums.

The Future of Cyber Insurance

As the digital landscape continues to evolve, so do the challenges and trends in the realm of cyber insurance. Emerging technologies, such as artificial intelligence and the Internet of Things, bring new risks and complexities that require proactive risk management and insurance solutions.

Regulatory frameworks surrounding cybersecurity and data privacy are also evolving, influencing the requirements and expectations for businesses regarding cyber insurance. Businesses should stay up-to-date with their cyber insurance policies, work closely with insurance providers, and stay informed about cyber threats to ensure adequate coverage.

Conclusion: Securing Your Business’s Future

In today’s interconnected and technology-driven world, businesses face significant financial risks from cyberattacks. The financial consequences of data breaches and ransomware attacks can be devastating, including costs related to breach response, legal liabilities, and reputational damage.

Cyber insurance is critical in protecting businesses from these risks by providing coverage for financial losses, legal expenses, and business interruptions. By investing in comprehensive cyber insurance coverage, businesses can ensure their continuity, mitigate financial risks, and recover more effectively from cyber incidents.

To safeguard their future, businesses should also adopt best practices for cyber risk mitigation, such as implementing strong cybersecurity measures, providing employee training, and conducting regular vulnerability assessments. Ongoing evaluation of cyber insurance policies is also crucial to keep pace with emerging trends, regulatory changes, and evolving business needs.