Renters insurance is essential for tenants, offering a range of protection against unexpected events. One lesser-known but vital feature is the “loss of use” coverage, which kicks in when your rental property becomes uninhabitable due to a covered peril like fire or flooding. This article dives into what loss of use covers, including temporary housing, and guides you through claiming these benefits.

Does Renters Insurance Cover Temporary Housing?

Loss of use coverage is part of most renters insurance policies. It comes into play when a covered event, such as a natural disaster or major damage, renders your home unfit for living. When this happens, your insurance policy can cover additional living expenses, helping you manage the financial burden during this stressful time.

The extent of this coverage is governed by the limits set in your policy, which usually state the maximum amount the insurance will pay and how long the coverage lasts. Understanding these details is crucial to know when to rely on this coverage.

Hotel Stay Coverage Under Renters Insurance

If your apartment is damaged and repairs are needed, your renters insurance might cover the cost of a hotel stay. However, there are conditions to this coverage. The alternative accommodation like a hotel room must be comparable to your rented space. For instance, if you’re renting a studio, your insurance is unlikely to cover a luxurious suite. Always contact your insurance provider to verify what is covered before booking.

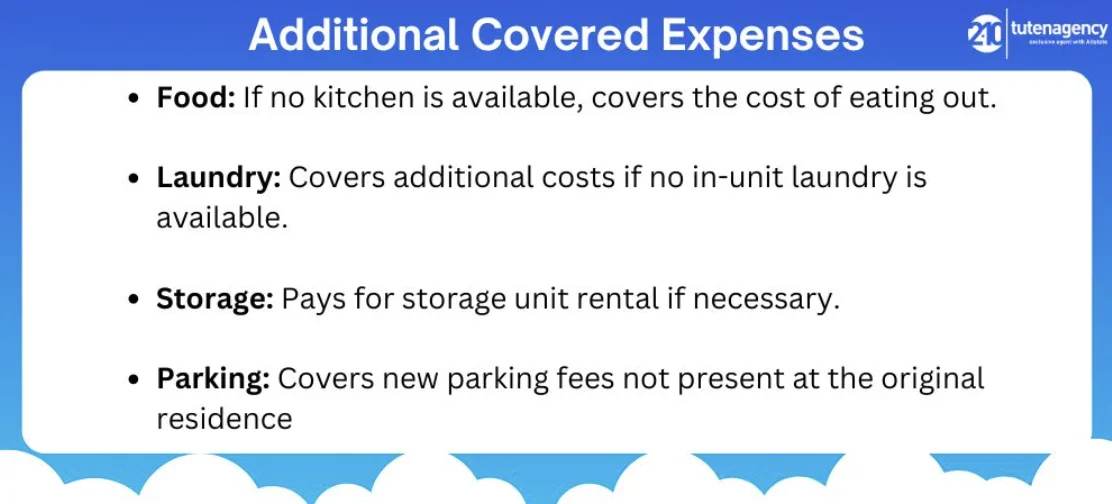

Additional Covered Expenses During Displacement

Food Expenses

Your daily routines, including meal preparations, are disrupted when you are displaced from your home. If your temporary accommodations don’t include a kitchen, your insurance may cover the additional cost of eating out over what you usually spend on groceries. Record these expenses to show the increased costs due to displacement.

Laundry Costs

Renters insurance might also cover additional laundry expenses if you’re displaced. If your rental had an in-unit washer and dryer but you needed to use a laundromat temporarily, your insurance would cover these extra costs. However, this only applies if you are already using coin-operated machines.

Storage Fees

Sometimes, the personal property needs to be stored during extensive repairs. If you need to rent a storage unit, your loss of use coverage may cover this cost. Keep the receipts and check your policy for specifics on storage coverage.

Parking Fees

If your temporary housing solution includes parking fees that weren’t a factor at your regular residence, your insurance may cover these expenses. This benefit helps mitigate the small but accumulating costs that can add significant stress during displacement.

Claiming Your Temporary Housing Expenses

To ensure you’re reimbursed for your temporary housing expenses under the loss of use coverage, thorough documentation is essential. Follow these steps to make your claim:

-

Keep All Receipts:

Collect and organize receipts for your hotel stays, meals, laundry, parking, and other related expenses.

-

Document the Circumstances:

Provide a detailed explanation of why your rental unit became uninhabitable, including photos or reports if possible.

-

Submit Your Claim Promptly:

Contact your insurance provider as soon as possible to submit your claim and all necessary documentation.

-

Follow-up:

Stay in touch with your insurance company to track the status of your claim and provide additional information if required.

Summary

Understanding the nuances of your renter’s insurance policy, especially the loss of use coverage, is vital. It ensures that you can handle where to stay or how to manage additional living expenses in times of crisis. By being well-informed and prepared, you can navigate the challenges of displacement with confidence and security. Keep this guide handy, and review your insurance policy to ensure you know what’s covered. This way, you can focus on returning to normal life with one less worry.

FAQs

What if I choose to stay with friends or family instead of a hotel?

If you opt to stay with friends or family instead of renting a hotel room or another form of paid lodging, your renters insurance might offer a “fair rental value” payment. This payment compensates you for the expenses you save your host, though policies vary significantly, so check with your insurance provider.

Does renters insurance cover moving costs if I need to permanently relocate?

If a covered peril destroys your rental property and you need to move to a new permanent home, your renters insurance may cover reasonable moving expenses. Confirm the details with your insurance provider, as this type of coverage can vary.

How long will my renters insurance cover additional living expenses?

The duration that your insurance will cover additional living expenses is typically capped by a time limit or a cost limit, or sometimes both, detailed in your policy. It’s important to understand these limits to plan accordingly.

Can I upgrade my temporary accommodations and pay the difference?

If you wish to upgrade your temporary accommodations beyond what your policy covers, you generally can do so at your own expense. Your insurance will likely cover up to the amount equivalent to your normal living expenses, and you would be responsible for any additional costs.

Get the right coverage for your rental home with tutenagency

New tutenagency customers?

Quote rental home insurance online or call (334) 502-5111 to insure rental home.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.