Towing coverage is a crucial component of auto insurance, offering significant relief during emergencies. It activates when your vehicle breaks down or is involved in an accident, providing the necessary support to tow your car to a repair shop or a secure location. Familiarizing yourself with the details of this coverage is vital for making well-informed choices regarding your auto insurance policy.

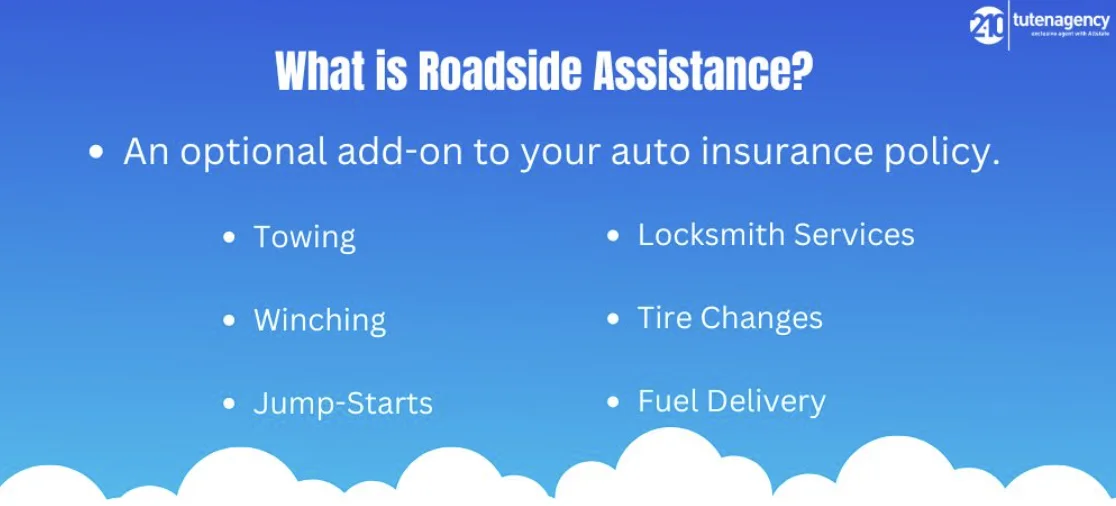

What is Roadside Assistance?

Roadside assistance is an optional feature that can be included in your auto insurance policy. It offers support when your vehicle experiences issues while driving. The common services provided under roadside assistance include:

- Towing: If your car can’t be driven, it will be transported to a nearby repair facility.

- Winching: If your car becomes lodged in mud, snow, water, or sand, it can be pulled out.

- Jump-starts: This service helps restart your vehicle if the battery dies.

- Locksmith services: If you are out, a professional can help you get back into your car.

- Tire changes: If you encounter a flat tire, it can be swapped out for your spare.

- Fuel delivery: If you run out of gas, fuel can be delivered on the road (you pay for the fuel).

Including roadside assistance in your policy ensures that help is just a phone call away, making it a valuable addition to peace of mind.

When Does Auto Insurance Cover Towing?

Towing is covered under auto insurance in two main scenarios: if your car breaks down or is involved in an accident. Roadside assistance can cover towing to the nearest workshop if your car stops working because of a mechanical issue and cannot be driven. Likewise, towing is generally included in the coverage if your vehicle is damaged in an accident and becomes inoperable.

Specifics of Towing Coverage

The specifics of towing coverage can vary. Most insurance policies cover towing up to a certain distance or to the nearest qualified repair facility. It’s Important to check your policy for the exact details, such as the maximum distance for towing or any additional costs you might need to pay.

Additional Roadside Assistance Benefits

Besides towing, roadside assistance might include several other benefits. Locksmith services are handy if you lock your keys inside your car. If you’re on a long trip and your car breaks down more than 100 miles from home, trip interruption coverage might reimburse you for expenses like lodging and food while your vehicle is repaired.

Roadside Assistance as a Claim

Utilizing roadside assistance is considered a claim on your insurance, but it is typically a streamlined process. Instead of going through the usual claims process, you should immediately call a specific number that dispatches help. This quick service minimizes your wait time and gets you back on the road or to safety without major delays.

Coverage After an Accident

If another driver causes an accident, their insurance usually covers the towing costs for your vehicle. However, if you are found to be at fault, your coverage will apply, depending on the specifics of your policy.

Impound Fees and Insurance

It’s important to note that auto insurance does not cover impound fees. If your vehicle is taken to an impound lot, you must retrieve it quickly to avoid additional charges. These fees can accumulate daily, so prompt action is necessary.

Choosing the Right Coverage

Consider your typical driving habits and routes when choosing roadside assistance or towing coverage. Comprehensive roadside assistance might be a wise choice if you often drive far from home or if your vehicle is older and more prone to issues. Always read your policy details carefully to understand what is covered and what your responsibilities are in an emergency.

Conclusion

Towing and roadside assistance can significantly ease your stress in challenging situations on the road. By understanding and choosing the right coverage options for your auto insurance policy, you can ensure you’re prepared for any roadside emergency. Always review your policy details and adjust your coverage to stay protected whenever you hit the road.

FAQs

How many times can I use roadside assistance in a year?

The number of times you can use roadside assistance in a year generally varies by insurance provider and policy. Some policies may have a limit on the number of uses per year, while others might offer unlimited usage. It’s important to review your policy or contact your insurance provider for specific details.

Does roadside assistance cover towing for all types of vehicles, including motorcycles and RVs?

Coverage for different types of vehicles, such as motorcycles, RVs, or trailers, can vary among insurance providers. Some companies might require additional coverage or have different rules for these vehicles. Always check with your insurance company to confirm what types of vehicles are included under your roadside assistance plan.

Are there any exclusions I should be aware of with roadside assistance coverage?

Yes, there can be exclusions. Common exclusions include services for vehicles already at a repair shop or home, repeated service calls for the same ongoing issue, or incidents occurring off-road or on non-public roads. Review your policy’s terms and conditions for specific exclusions.

What happens if the roadside assistance service can’t fix my car on the spot?

If the roadside service cannot fix your car on the spot, they will typically tow it to the nearest qualified repair shop for further diagnosis and repair. Your coverage details will determine whether there are any limitations on the towing distance or if additional costs may apply.

Get the right coverage for your car with tutenagency

New tutenagency customers?

Quote auto insurance online or call (334) 502-5111 to insure your vehicle.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.