Experiencing a house fire is devastating and disorienting. Beyond the immediate danger, the aftermath of a fire is a challenging period filled with uncertainty. Understanding the right steps can help you and your family manage the situation and rebuild your lives. This guide outlines practical steps after a house fire, from securing temporary housing to dealing with insurance and replacing vital documents.

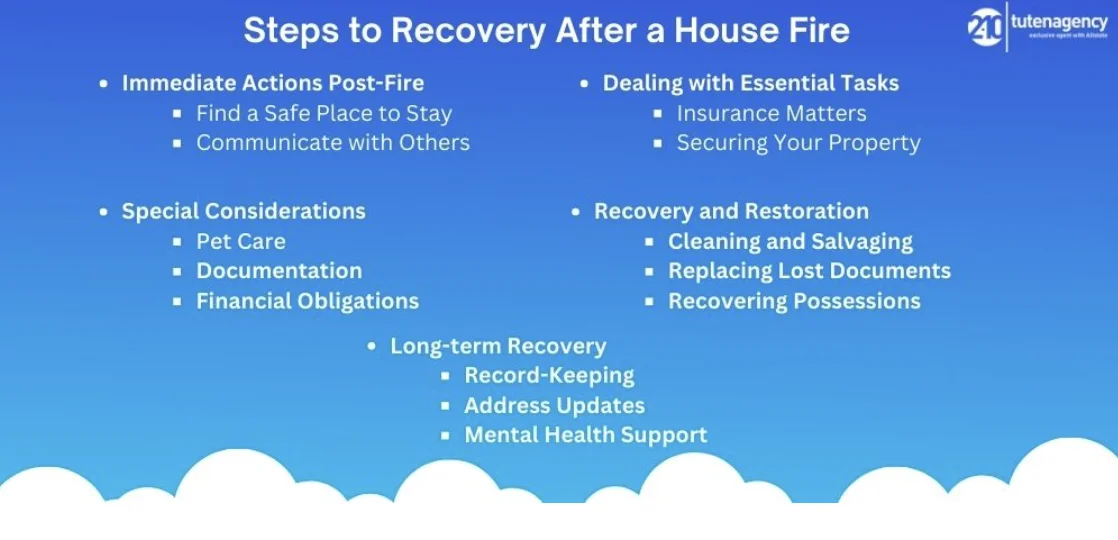

Immediate Actions Post-Fire

A. Finding a Safe Place to Stay

Safety is your top priority after a house fire. If your home is severely damaged and unsafe, you’ll need to find an alternative place to live temporarily. Family and friends may offer immediate shelter, often the most comforting option.

B. Communicating with Others

Once you are safe, inform your family and friends about your situation. This will not only reassure them of your safety but can also activate a network of support, which is crucial during such times.

Dealing with Essential Tasks

A. Insurance Matters

Contact your insurance company as soon as possible to start the claims process. If your home is uninhabitable, you will likely need funds to cover daily expenses. Most insurance policies include coverage for “Loss of Use,” which provides an advance for such situations. Keep all receipts related to your temporary living expenses and any purchases made due to the fire. These documents are essential for your insurance claim.

B. Securing Your Property

Your responsibility is to protect your property from further damage. This includes safeguarding it against the elements and unauthorized access. Consult your insurance agent for advice on the best ways to secure your property adequately.

Special Considerations

A. Pet Care

If you have pets, the fire might affect their health. Take them to a veterinarian to check for smoke inhalation and any hidden injuries.

B. Documentation

Obtain a copy of the fire report from the fire department, which will be useful for insurance claims. Also, photograph your property and the damage when it is safe. These photos are vital for documenting the losses and will support your insurance claim.

C. Financial Obligations

Keep up with your mortgage and other financial obligations despite the fire. It’s crucial to continue making these payments to avoid financial complications down the line.

Recovery and Restoration

A. Cleaning and Salvaging

Determine which items are salvageable and which should be discarded. Fire can contaminate or irrevocably damage many materials, making them unsafe. Take photos of all items you need to discard for insurance purposes.

B. Replacing Lost Documents

Personal documents like passports, birth certificates, and marriage licenses destroyed in the fire must be replaced. If these were kept in a safe, check it as soon as you’re allowed back into your home. Begin the replacement process for lost documents as soon as possible.

C. Recovering Possessions

For your insurance claim, make a comprehensive list of all items lost in the fire. Include details like purchase date, cost, and description of each item. This list is crucial for ensuring you are fairly compensated.

Long-term Recovery

A. Record-Keeping

Keep detailed records and notes throughout the recovery process. Organize all documentation related to repairs, expenses, and insurance claims. A binder or folder can be very helpful in keeping these records organized.

B. Address Updates

If you anticipate being displaced for an extended period, update your mailing address with the post office. This ensures you continue receiving mail and important documents during your displacement.

C. Mental Health Support

The emotional toll of a house fire is often significant. It’s vital to acknowledge and address the mental health of your family members and yourself. Think about getting help from mental health professionals if you or a family member are having a hard time coping with the aftermath.

Summary

Recovering from a house fire involves practical steps and emotional adjustments. While the journey may be difficult, having a clear plan can provide a sense of control and direction. Utilize all available resources and support systems to help you through this time, and remember; it’s okay to ask for help as you work towards rebuilding your life.

FAQs

How long does it usually take to process a house fire insurance claim?

The time it takes to process a fire insurance claim can vary widely depending on the extent of the damage, your insurance company’s policies, and how quickly and thoroughly you can provide necessary documentation. Generally, it may take a few weeks to several months.

What should I do if I find lost items after I’ve already settled my insurance claim?

If you discover items that were presumed lost after settling your insurance claim, you should contact your insurance company immediately. They will guide you on the steps to take, which may include amending your claim.

How can I safeguard my home against future fires?

Implementing fire prevention measures is crucial. This can include installing smoke alarms on every floor and near all sleeping areas, regularly checking electrical wiring, avoiding overloaded outlets, and keeping flammable materials away from heat sources. Regularly practicing fire escape plans with all family members is also important.

What immediate safety hazards should I be aware of after a fire?

After a fire, be aware of potential safety hazards such as weakened structures, sharp objects, exposed electrical wires, and toxic fumes from burnt materials. Do not re-enter your home until it has been declared safe by fire department officials.

Get the right coverage for your home with tutenagency

New tutenagency customers?

Quote homeowners insurance online or call (334) 502-5111 to insure your home.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.