I Need a Free Policy Review and Honest Quote!

At tutenagency we pride ourselves on being a value-add to our clients. No fluff or unnecessary recommendations. Just expert guidance, transparent quotes and unparalleled service. Sign up below and discover the tutenagency difference.

Benefits of using tutenagency

Peace of Mind

We strive to help you sleep better at night knowing you and your loved ones are protected

Jealous Neighbors

If we make your non-Allstate neighbors jealous because your coverage is better than theirs, we’re okay with that

Tailor-Made

Our goal is to create custom fitted insurance policies that feel like custom fitted clothes

VIP Service

We want you to feel like an A-List celebrity when you see our response times and customer service

We Make it Easy for You

Our team will help you effortlessly find the right personal insurance tailored to your needs:

-

Auto Insurance -

Homeowners Insurance -

Condo Insurance -

Renters Insurance -

Personal Umbrella Insurance -

Life Insurance -

Motorcycle Insurance -

Boaters Insurance -

ATV/off-road Insurance

H.L. “Rye” Tuten, III

President & CEO

“Welcome to tutenagency, where expertise meets personalized protection. We specialize in crafting bespoke coverage plans to safeguard your unique lifestyle. Let us bring you peace of mind by tailoring solutions that make sense for you.”

2000

Satisfied Customers

10

+

Years Of Experience

Price

Understandably, everyone wants to save money. Like you, many individuals are looking for insurance that doesn’t break the bank. Switching to a more affordable provider could free up funds for those things you’ve been dreaming of – whether it’s a family vacation, home improvements, or simply having a little extra for the things you enjoy.

Coverage

We get it – insurance isn’t just a piece of paper; it’s peace of mind. If you’ve ever worried about whether your current policy would really cover you in a time of need, you’re not alone. Switching to a provider that offers coverage tailored to your specific life circumstances can bring you the assurance that you and your loved ones are protected.

Customer Service

Customer service matters because you deserve to be heard and supported when you need it most. Switching to a provider that treats you as a person, not just a policy number, can make a world of difference in your insurance experience. Imagine having a dedicated agent who knows your name and understands your unique situation.

Policy Changes

Life doesn’t stand still, and neither should your insurance. If your family is growing, or you’ve recently made significant life changes, switching to an insurer that adapts your coverage as your life evolves ensures that your policy stays in sync with your needs.

Better Benefits

Sometimes, it’s the little things that matter. Imagine having a trusted insurance partner who not only offers great coverage but also provides additional perks that make your daily life easier – like a stress-free claims process or added services that go above and beyond.

Latest Blog & Articles

Communicate with Us!

Have questions about insurance policies, billing, claims or anything else? No problem! Reach out and we’d be happy to help.

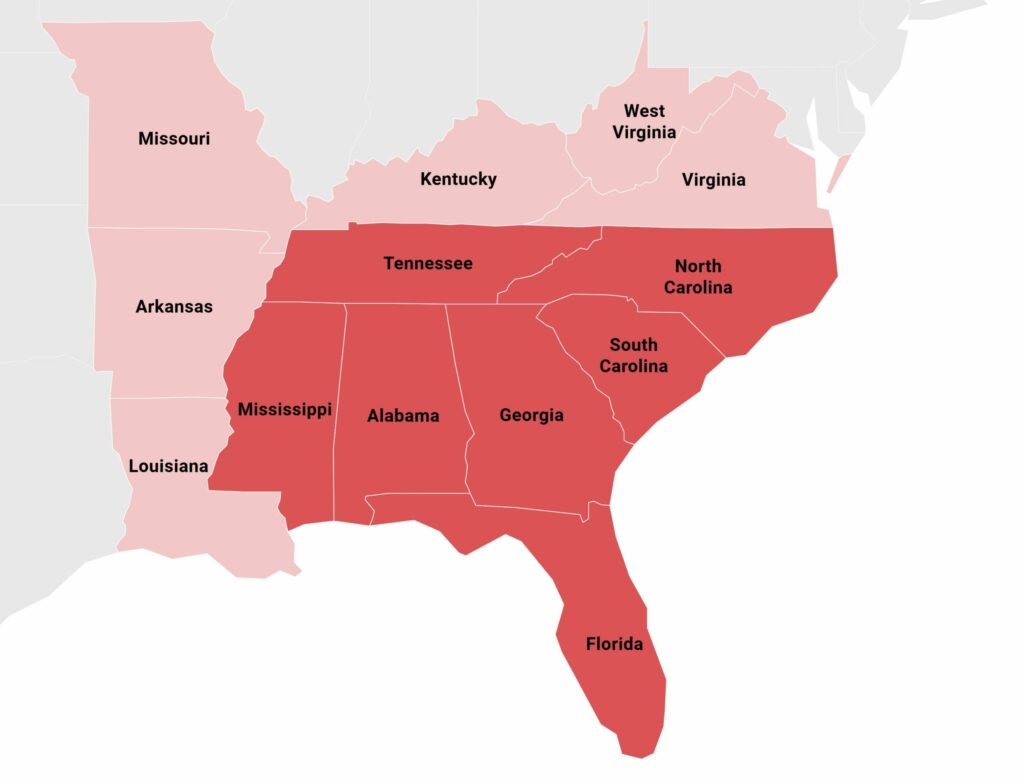

We are your reliable insurance agency, dedicated to serving you in Alabama

We are your reliable insurance agency, dedicated to serving you in Georgia