Luxury homes represent more than just real estate; they are investments and often dream homes. These homes are typically expensive to rebuild and require special insurance policies to protect them adequately. Homeowners with luxury properties need to be aware of the unique insurance needs that come with high-value homes.

This article will explore the specifics of homeowners insurance for luxury homes and the critical coverages that can aid in safeguarding your property, belongings, and assets.

High-Value Home Insurance Policies

Homes that are expensive to rebuild often require specialized insurance policies. Although standard homeowners insurance may offer some coverage for high-value homes, many insurers offer specialized policies with more comprehensive coverage tailored to luxury properties.

For instance, some insurers provide policies that cover homes valued up to several million dollars. This ensures that even the most valuable homes can be adequately insured. These insurers also mandate exterior and interior inspections for properties with high replacement costs. These inspections help determine the appropriate dwelling replacement amount, ensuring you have sufficient coverage to rebuild your home in a disaster.

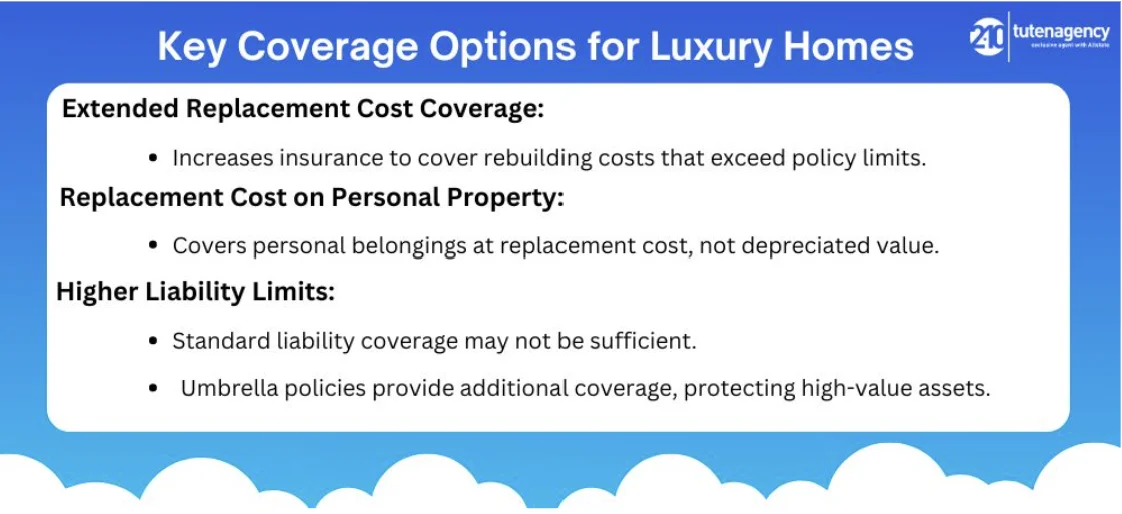

Key Coverage Options for Luxury Homes

Extended Replacement Cost Coverage

One of the most important coverages for luxury homes is extended replacement cost coverage. This coverage increases the insurance you have for your home, ensuring it can be completely rebuilt after a covered loss, even if the rebuilding costs exceed the initial policy limit. This is particularly crucial during disasters when construction costs can soar due to high demand for labor and materials.

Replacement Cost on Personal Property

Many standard homeowners insurance policies only cover personal belongings at their actual cash value, which accounts for depreciation. However, homeowners can choose replacement cost coverage for their personal property. This option raises the premium but provides more comprehensive protection. With replacement cost coverage, if your belongings are damaged or destroyed in a covered incident, the insurance will pay to replace them without factoring in depreciation. This means you can replace your items with new ones of similar quality.

Higher Liability Limits

Liability coverage is fundamental to homeowners insurance, offering protection if you’re legally responsible for someone else’s injuries or property damage. However, more than the standard liability limits may be required for luxury homeowners. If your net worth exceeds the maximum limit of your policy’s liability coverage, you can purchase an umbrella policy. An umbrella policy provides additional liability coverage, offering extra protection for your assets beyond the standard limits.

Insurance Requirements for High-Value Homes

High-value homes often require more detailed inspections to determine the appropriate coverage amounts. Insurers conduct both exterior and interior inspections for homes with high replacement costs. These inspections help assess the condition and value of the property, ensuring that the dwelling replacement amount is sufficient to cover the cost of rebuilding the home.

The exterior inspection typically includes evaluating the home’s structure, roof, and other external features. The interior home inspection involves assessing the quality of materials used inside the home, such as flooring, countertops, and fixtures. Based on the inspection results, your insurance policy’s dwelling replacement amount may be adjusted to provide adequate coverage.

Protecting Your Luxury Property, Belongings, and Assets

Insurance coverage protects your luxury home, personal belongings, and assets. Here are some strategies to ensure comprehensive protection:

- Choose Replacement Cost Coverage: Instead of actual cash value coverage, choose replacement coverage for your personal property. This ensures that you can substitute damaged or destroyed items with new ones of comparable quality.

- Increase Liability Limits: To protect your high-value assets, more than standard liability coverage may be needed. Consider purchasing an umbrella policy to increase liability limits and safeguard assets.

- Conduct Regular Inspections: Ensure your home is inspected to assess its value accurately. This helps maintain adequate dwelling replacement amounts and ensures comprehensive coverage.

- Regularly Review and Update Your Policy: Review your homeowner’s insurance policy to ensure it meets your current needs. Update your coverage amounts as necessary to account for any improvements or changes to your property.

Summary

Luxury homes require specialized insurance coverage to ensure they are adequately protected. High-value home insurance policies, extended replacement cost coverage, replacement cost on personal property, and higher liability limits are essential components of comprehensive coverage for luxury properties.

By understanding and implementing these key coverages, you can effectively protect your home, belongings, and assets.

FAQs

What factors affect the cost of insuring a luxury home?

Several factors influence the cost of insuring a luxury home, including the home’s location, size, age, construction materials, unique features, and the value of the contents inside the home. The level of coverage and any additional endorsements or riders also play a role.

What is an umbrella policy, and how does it benefit luxury homeowners?

An umbrella policy provides additional liability coverage beyond the limits of your standard homeowners policy. For luxury homeowners with significant assets, this extra protection is crucial to safeguard against large liability claims or lawsuits.

What should I do in case of a claim on my luxury home insurance?

In the event of a claim, immediately contact your insurance provider to report the loss. Document the damage with photos or videos, and keep receipts or appraisals for high-value items. Your insurer will guide you through the claims process to ensure you receive the appropriate compensation.

How can I lower the premium on my luxury home insurance?

To lower your premium, you can increase your deductible, install security and safety systems, maintain a good credit score, and review your coverage regularly to eliminate any unnecessary endorsements. Always compare quotes from multiple insurers to find the best rate for the coverage you need.

Get the right coverage for your home with tutenagency

New tutenagency customers?

Quote homeowners insurance online or call (334) 502-5111 to insure your home.

Legal Disclaimer: ADVERTISING MATERIAL ONLY. Do not rely on this site or this article for legal or financial advice. The information provided on 210agency.com is strictly for educational purposes and to provide you with general educational information. Since state laws and financial regulations are subject to change, please schedule an appointment with an attorney or qualified financial advisor in your area to further discuss your personal situation. This public information is neither intended to, nor will it, create an attorney-client or financial representative relationship.